Running a car can be expensive. Everything from the initial purchase, refuelling, servicing costs and — perhaps most annoying of all — insurance.

It often feels like insurance companies are out to get every pound from your pocket — offering premiums that seem more ridiculous year-on-year. It doesn’t have to be this way though, and there’s plenty of steps you can take to cut down your insurance costs.

Increase your excess

It might be tempting to keep your excess low to minimise the upfront cost should the worst happen to your car, but this can result in much higher premiums.

Experiment with the different excess costs when you’re shopping around. Your policy price could tumble by simply adding £50 more to your excess. Of course, make sure you can afford to stump up the cash in the event of an accident.

Consider your annual mileage

Are you covering a few thousand miles less annually than your insurance allows? Reducing your quoted mileage will bring the premiums right down.

The more miles you tell your insurer you’re doing, the more of a risk you are to them — meaning a higher price to pay for you. Sure, it’s hard to predict exactly how many miles we’re going to cover in a year — but if there’s noticeably more left over, don’t be afraid to cut them out of your policy.

Keep the number of named drivers down

While adding a more experienced driver to a policy may result in lower costs, adding multiple users will see it soar back up.

If someone on the policy uses the car once or twice a year — drop them from it and use a temporary cover service when they need the vehicle. Your wallet will be much better off for it.

Add an alarm system

Although most new cars are fitted with seriously good security equipment, some older models lack the modern luxury of a decent anti-theft protection system.

If your car is lacking, investing in an aftermarket alarm system with an immobiliser will result in long-run savings by way of cheaper insurance premiums — especially if you fit a Thatcham-approved system.

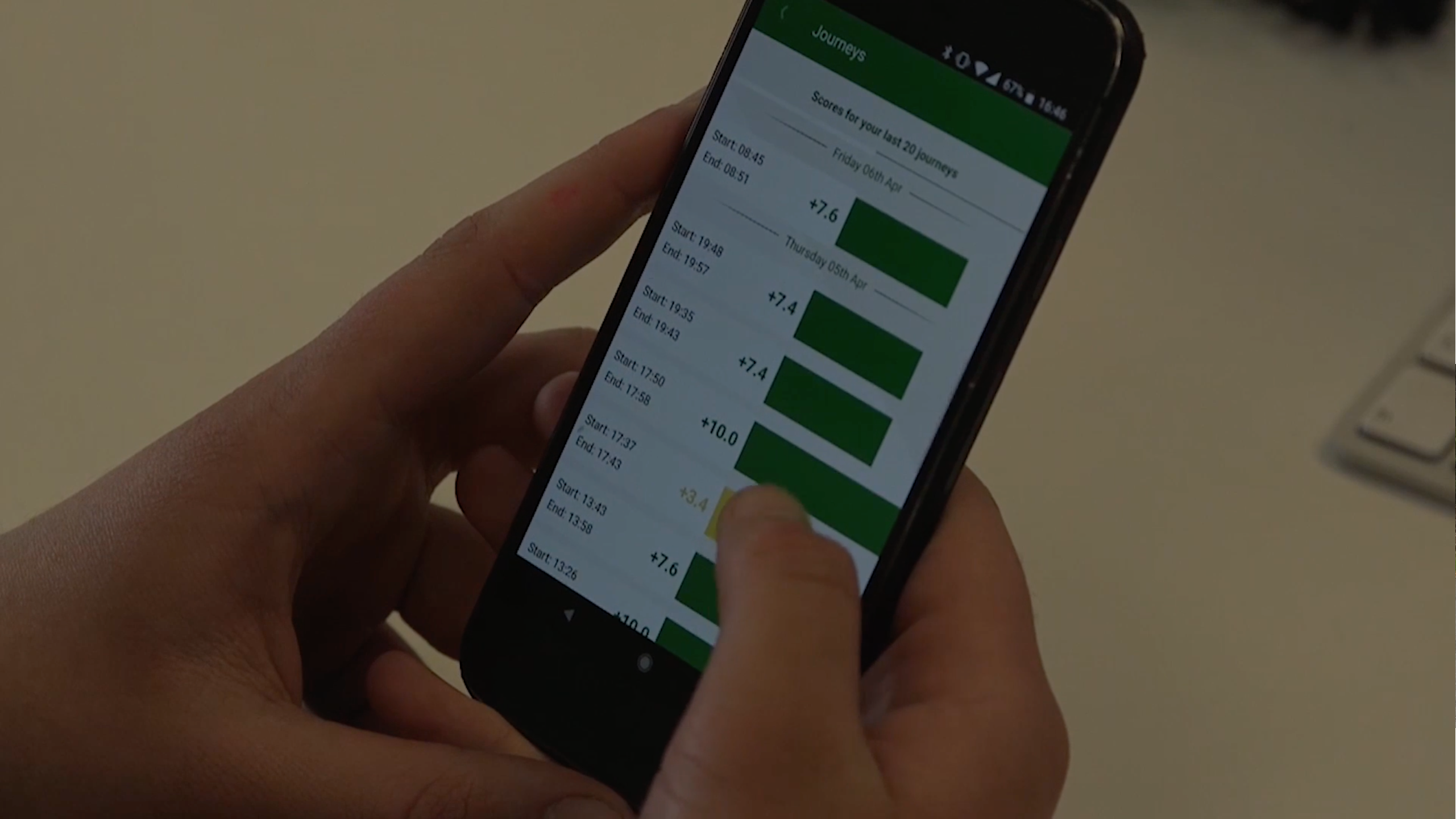

Opt for a blackbox policy

For younger drivers in particular, a blackbox policy can drastically reduce the annual cost of insuring your car.

Insurers offering a blackbox policy will fit a data recorder to your car allowing them to monitor your driving habits, mileage covered and where you’ve been. It may sound rather Big Brother and terrifying but as they can track exactly how you’re driving, your initial cost is reduced and good habits on the roads can lead to huge discounts at renewal.

Are the extras necessary?

Car insurers like to offer plenty of extras alongside the standard policy to give buyers more cover — but these come as an extra cost.

While things like breakdown and courtesy car cover sound like a smart addition, these can often be found cheaper elsewhere rather than alongside the policy — while extras like cover while driving abroad may be totally unnecessary.

Garage your car

If you’ve got a garage that can fit your car, but it’s instead filled with bicycles, dog toys and Venga Boys records, it might be time to clear it out.

Securely parking your car in a garage makes it a much safer prospect in the eyes of insurers as it’s out of the eyes of potential thieves and clear of any potential damage while parked. This means your premiums could tumble.

Similarly, if you can park in a secure area at work, letting your insurer know can bring the price down too.

Pay annually — if you can afford to

Monthly payments are convenient — it means you can spread the cost over a year, which can be a great option for those on a budget.

The total price when paying monthly is often noticeably higher than paying the annual insurance in one lump sum, though. If you can afford to pay for a full year’s cover in one — you’ll save a lot in the long run.

Of course, only do this if you know you can afford to. Taking out bank loans or using a credit card will end up costing more than a monthly direct debit.

Take a Pass Plus course

Pass Plus courses are great for any motorist — new or old. If you’re fresh on the roads, it can give you more in-depth experience behind the wheel while still having the safety of a qualified instructor in the passenger seat. Those with more experience can still take a Pass Plus and refresh themselves on the rules of the road and eradicate any bad habits.

Insurers recognise the benefits of Pass Plus courses and offer discounts for those who have taken them. You’re a safer and more experienced driver in their eyes, making you less of a risk.

Don’t be afraid to shop around

As convenient as it may be to head onto a price comparison site and pick the cheapest deal from there for your insurance, it’s not going to save you much money.

Use that as a starting point, and then don’t be afraid to pick up the phone. Tell one insurer of another’s prices and see if they’ll offer a better deal — and if they do, go back to the first and let them know. You could knock hundreds of pounds off your premium with an hour of calls if you’re savvy enough.