Although buying a new car can be an exciting time, it can also be stressful. There’s a lot to consider: what make and model to choose, what engine type do I want, which option boxes should I tick and – perhaps most crucially – how will I pay for it?

In an ideal world, we’d all save up enough money to pay one lump sum for a new set of wheels but for most that’s simply not an option, leaving many pondering the question of applying for a personal loan or opting for finance when purchasing their new vehicle. We take a look at both to help you choose how to pay for your next car.

Bank loans

What’s good about a bank loan?

When taking out a bank loan, you borrow a set amount of money agreed that is paid back over a period of time agreed with your creditor. As a loan is not secured against your vehicle, the car is yours from the moment you pick it up.

Unlike car finance, you also don’t need to place an initial deposit to borrow the money – which could land you in a new car sooner than saving for an initial finance payment would. Also, bank loans do not limit your annual mileage in a vehicle, like many finance options do.

Opting for a bank loan also gives you the freedom to shop around to find the best interest rates. Remember, you’re not just limited to the bank you hold an account with when seeking a loan.

Is there a catch?

As with anything, bank loans are not all plain-sailing. They’re generally a lot harder to successfully apply for than car finance, as creditors are more likely to refuse you if your credit rating is poor.

Loan interest rates are also often higher and can increase after your initial application.

Car finance

What are the advantages of car finance?

Financing a car can be an easier process than using a bank loan to purchase a car, as its usually agreed through a dealership when buying a vehicle. Financing also usually brings lower interest rates and you’re more likely to be approved if you have a poor credit rating than you would a bank loan.

There are two main types of finance available – hire purchase (HP) and personal contract purchase (PCP).

What’s the difference between HP and PCP?

HP is pretty easy to understand. The list price of a car is broken down into a deposit and a number of monthly payments – the number of which is agreed with your creditor. Interest is added, so you ultimately pay a little more than if you were to pay in full, but the car is yours to keep once the full balance is covered. Hire purchase is also available on used cars.

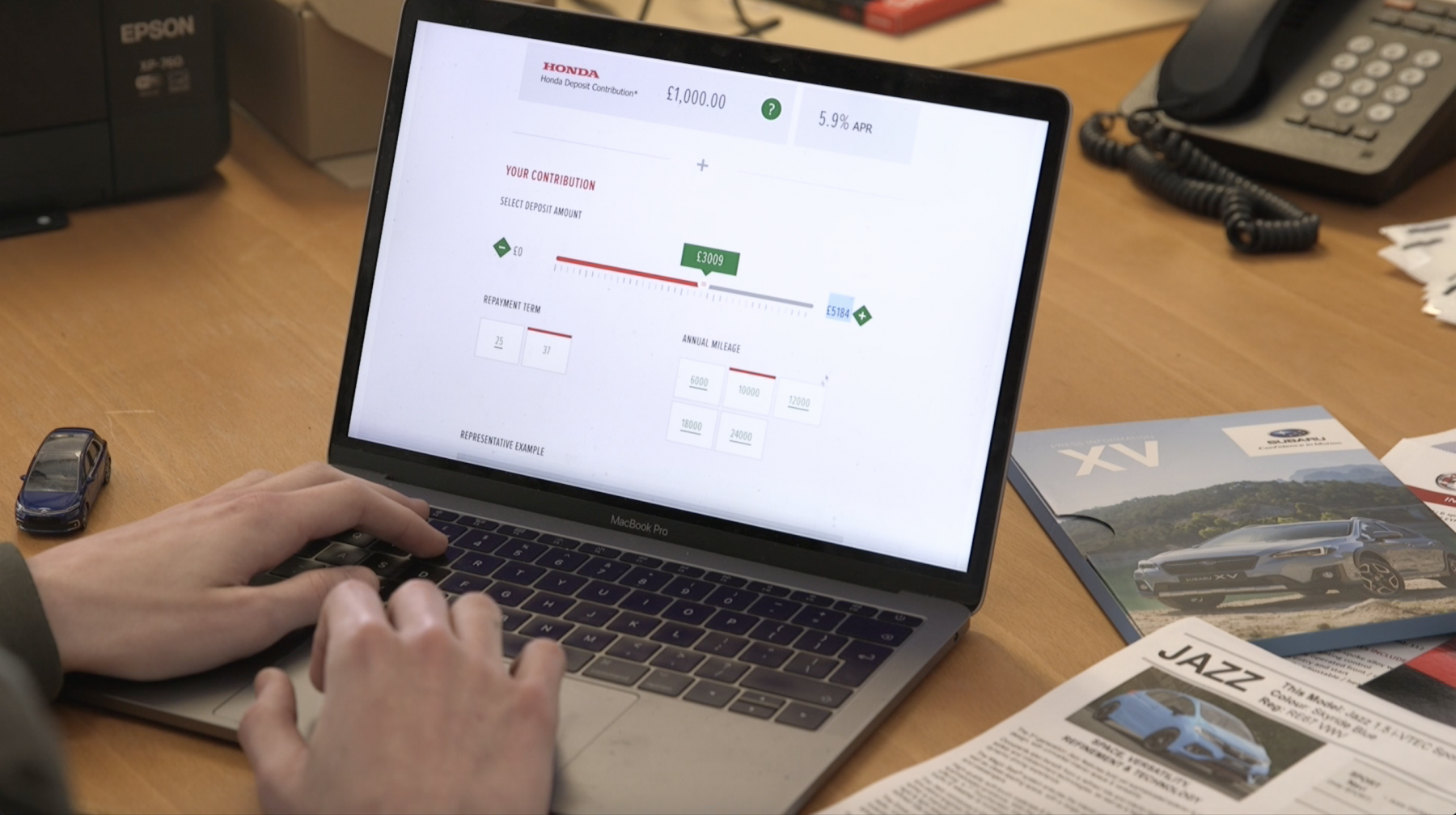

PCP can be a little more complicated, as it’s usually split in three phases. There’s usually an initial deposit that can be agreed with the dealership, although from time-to-time you may find a nil-deposit offer. Then, there’s the monthly deposits – the time of which varies, although most contracts are over a three-year period.

Finally, at the end of your monthly payments, you have a choice of three options. First, you can hand the keys back to the dealer with no extra fees – meaning the car is no longer yours. If you wish to keep the car, you can pay a settlement fee and the vehicle then belongs to you or, if you wish to upgrade, you can trade the vehicle in towards a new one with any value left over the settlement fee knocked off the price.

What’s not-so-good about finance?

While finance may sound like an easy option, it’s worth remembering you don’t own the car until all payments have been made on finance. If you struggle to keep up with payments, the finance company will have the right to repossess the vehicle.

There could also be mileage limitations and other stipulations applied to the car, as finance companies will want as little depreciation as possible in case you decide to return the vehicle.

Bank loan or car finance: what’s best for me?

Both car finance and bank loans should be considered and researched to your individual needs to work out exactly what is best for you, but some general rules do apply.

If you’re in a good credit standing, and can comfortably afford to pay it off, a bank loan could be your best bet as you own the car from day one and will have no limitations on vehicle usage. It can also work best for those who change cars often, particularly used, as the vehicle is not tied up in a contract.

For those with poorer credit standing, and particularly younger drivers who have little history, car finance may work best. It may mean the car isn’t yours until the end of the payment period, but it offers more flexibility and, in the case of PCP, upgrading to a new car is simple if you wish to do so at the end of the term.

Regardless of which you decided to choose, always research your options extensively and ensure you know the ins-and-outs of any payment contracts before you sign the dotted line.